Warren Buffett has been in the news lately, with his closely watched letter to Berkshire Hathaway shareholders and his famous 10 year wager about the performance of index funds versus actively managed funds about to come to fruition.

The letter to shareholders is viewed as investor gospel as the performance of his company, Berkshire Hathaway, has consistently beaten the S&P 500 index since 1964. In his most recent letter to shareholders he touts the company's investment gains would continue to be 'substantial' in the coming years and the U.S. economy would continue its 'miraculous' boom – a strong vote of confidence for what has been the longest running bull market in history.

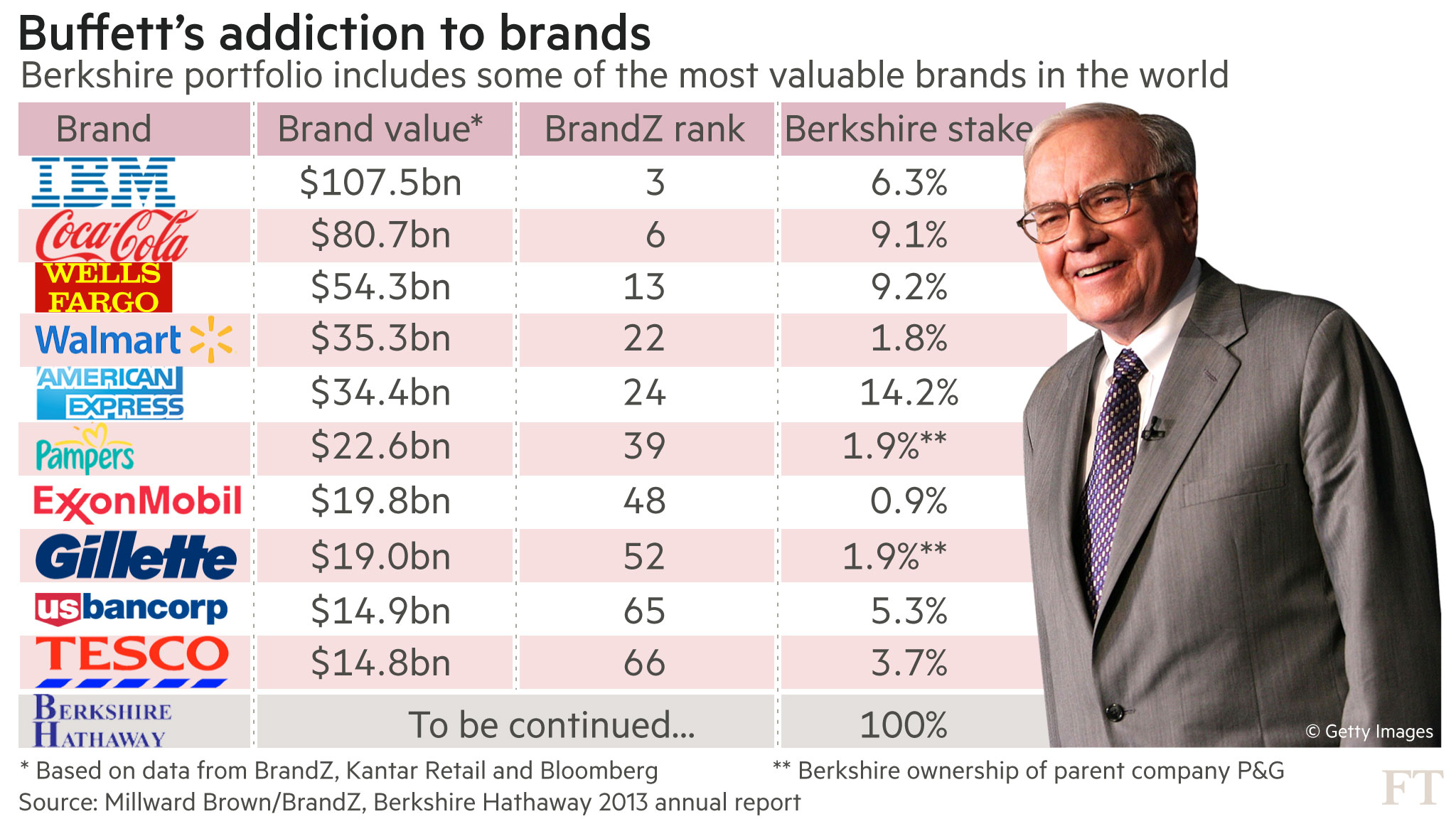

Source: Financial Times

His longer term view on how to produce returns runs against the conventional wisdom of Wall Street’s elites and focuses on passively managed index funds. The idea being that active management of hedge, venture and buyout funds bring with them significant fees that pull down lower net returns when compared to the minimal fees of index funds. His 10 year bet on this, with less than a year to go, shows passively managed index funds returns currently up 85% and trouncing hedge funds at 22%.

How has Buffett been innovative? Not only has he produced incredible and consistent performance through Berkshire Hathaway’s track record, he has also taken a non-traditional view of investing by proving passive index fund investing produces superior returns, particularly for ordinary investors.